Governor Signs Important New Housing Legislation Allowing Residential Development on Commercial Properties

Governor Signs Important New Housing Legislation Allowing

Residential Development on Commercial Properties

NOTE: Both AB 2011 and SB 6 go into effect on July 1, 2023.

On September 28, 2022, Governor Newsom signed two important bills designed to help address the state’s continuing housing crisis by requiring local governments to approve residential development “by right” in commercial zones under certain circumstances.

These two bills -- Assembly Bill 2011, known as the “Affordable Housing and High Road Jobs Act of 2022,” and Senate Bill 6, known as the “Middle Class Housing Act of 2022” – were the result of lengthy negotiations among California’s lawmakers, residential developers, construction trade unions, and local governments. Like much of California’s recent housing legislation, the bills override local zoning regulations – in this instance to allow residential development in commercial zones that would otherwise prohibit residential uses.

The bills present different tradeoffs. For example, AB 2011 provides a streamlined process and requires the local government to approve a qualifying project on a ministerial basis, making the project exempt from CEQA. However, AB 2011 requires the developer to include below market rate affordable units, pay prevailing wages to all construction workers and, under some circumstances, make a relocation payment to a displaced commercial tenant.

Although SB 6 does not have a streamlined ministerial process, it does not require the developer to include affordable units. However, like AB 2011, SB 6 requires the developer to pay prevailing wages to construction workers and make a relocation payment to a displaced commercial tenant. In addition, SB 6 requires that all construction contracts meet “skilled and trained workforce” requirements for construction workers, which, in practical terms, will likely require the majority of contractors and subcontractors performing work to be signatory with the construction trades unions.

The following table highlights the major differences between the two bills:

The bills’ requirements may make it difficult for many projects to take advantage of the legislation. However, with underperforming or obsolete retail and office projects continuing to face economic challenges, there may be good opportunities to build residential projects in some commercial areas. Both AB 2011 and SB 6 are important tools that residential developers should consider when evaluating residential development on commercial properties. For projects that can accommodate the construction labor and other requirements under AB 2011 or SB 6, these bills can be a key element of a developer’s land use entitlement strategy.

The following are high-level summaries of the key provisions of AB 2011 and SB 6. Both bills are quite detailed and will require careful project-by-project evaluation to ensure a project qualifies.

Streamlined Process

AB 2011

If the local government determines that a project submitted pursuant to AB 2011 is consistent with the objective planning standards, it must approve the project, and the approval is ministerial and therefore not subject to CEQA.

AB 2011 requires the local government to determine whether the project conflicts with any of its objective development standards. The local government must make a written determination of the project’s compliance with the development standards by the following deadlines:

- For a project with 150 or fewer units, within 60 days of submittal of the development proposal to the local government.

- For a project with more than 150 units, within 90 days of submittal.

If the local government fails to provide the required determination within these timeframes, then the project is deemed to satisfy the required objective development standards.

The local government’s design review process is limited to objective design criteria and is also subject to specified timelines:

- For a project with 150 or fewer units, design review must be completed within 60 days of submittal of the development proposal.

- For a project with more than 150 units, design review must be completed within 180 days of submittal.

SB 6

SB 6 does not provide a streamlined ministerial approval process.

Affordable Housing Requirements

AB 2011

To be eligible under AB 2011, a rental project must include either (i) 8% of the units for very low income households and 5% of the units for extremely low income households, or (ii) 15% of the units for lower income households. Rents must be set at an “affordable rent”, i.e., generally not to exceed 30% of the specified percentage of Area Median Income, except as otherwise provided in Section 50053 of the California Health and Safety Code. If the local government has an inclusionary housing requirement, the project must include the greater of the AB 2011 requirement or the local inclusionary requirement, with certain exceptions.

An owner-occupied (for sale) housing development must have either (i) 30% of the units offered at an affordable housing cost to moderate-income households, or (ii) 15% of the units must be offered at an affordable housing cost to lower income households.

AB 2011 also includes certain different provisions discussed below for projects where 100% of the units are rented at affordable rents using California Tax Credit Allocation Committee rent limits.

SB 6

SB 6 does not require any affordable housing to be included in the project.

Construction Labor Requirements

One of the most important aspects of the two bills for developers is the required construction labor standards.

AB 2011

To qualify as an AB 2011 project (whether 100% affordable or mixed-income), a developer must ensure that all construction workers are paid prevailing wages (other than apprentices in certain programs who may be paid the applicable apprentice prevailing rate) as established under California’s Prevailing Wage Law.

For projects that develop 50 or more housing units, additional labor standards apply. A contractor that employs construction craft employees or enters into subcontracts for at least 1,000 hours must either (i) participate in a state-approved apprenticeship program, or (ii) request the dispatch of apprentices from a state-approved apprenticeship program. This will require contractors and subcontractors generally to notify applicable apprenticeship programs of the existence of the project, request dispatch of apprentices, and employ apprentices in apprenticeable occupations in a ratio of five journeypersons to every apprentice and at reduced apprenticeship wage rates (but does not require non-union contractors or subcontractors to enter into a collective bargaining agreement with a union). Furthermore, each contractor that employs construction craft employees must make specified health care expenditures for each employee tied to the hourly pro rata cost of a specific Covered California health care plan.

AB 2011 includes extensive reporting, certification and monitoring requirements as well as robust enforcement provisions and penalties for non-compliance.

Many of these labor requirements can also be satisfied if the construction worker is covered by a collective bargaining agreement or if the contractor is party to a project labor agreement.

SB 6

For an SB 6 project to qualify, the developer must also ensure that all construction workers are paid the applicable rate of prevailing wages. In addition, apprentices in certain programs must be paid the applicable apprentice prevailing rate.

Importantly, unlike AB 2011, SB 6 also requires that the developer ensure that a “skilled and trained workforce” is used to perform all construction work on the development for every contractor and subcontractor at every tier. A “skilled and trained workforce” is one for which all workers performing work in an apprenticeable occupation in the building and construction trades are either skilled journeypersons or apprentices registered in a State or federally approved apprenticeship program. A “skilled journeyperson” is one that has either graduated from an approved apprenticeship program or has at least as many hours of on-the-job experience as would be required to graduate from an apprenticeship program for the applicable occupation. Because the skilled and trained workforce statutes require a minimum percentage of all workers in an apprenticeable occupation to be graduates or apprentices of an approved program, and because the large majority of apprenticeship programs are union-affiliated programs, the skilled and trained workforce requirement generally means that contractors or subcontractors employing workers on the project will be signatory with the construction unions.

However, SB 6 includes an exception to the skilled and trained workforce requirement if the prescribed construction bidding process does not yield two bids from qualified prime contractors that agree to meet the requirement. If, after complying with extensive prequalification, notice and bidding procedures, the developer receives fewer than two bids from prequalified prime contractors that agree to meet the skilled and trained workforce requirement, the contract may be rebid without the requirement. A similar exception allows the prime contractor to rebid subcontracts without the skilled and trained workforce requirement if the prime contractor receives fewer than two bids from prequalified subcontractors that agree to the requirement.

SB 6 also requires extensive reporting, certification and monitoring requirements and provides for robust enforcement and penalties. SB 6 exempts some reporting and enforcement provisions and other requirements if the project is covered by a project labor agreement with specified provisions.

Method for Calculating Density

Because commercial zones in many jurisdictions do not allow residential uses and therefore do not prescribe residential density or height standards, both AB 2011 and SB 6 provide a methodology for establishing those standards. Under AB 2011, different methods apply depending on whether the project is 100% affordable or includes a mix of market rate and affordable units.

AB 2011

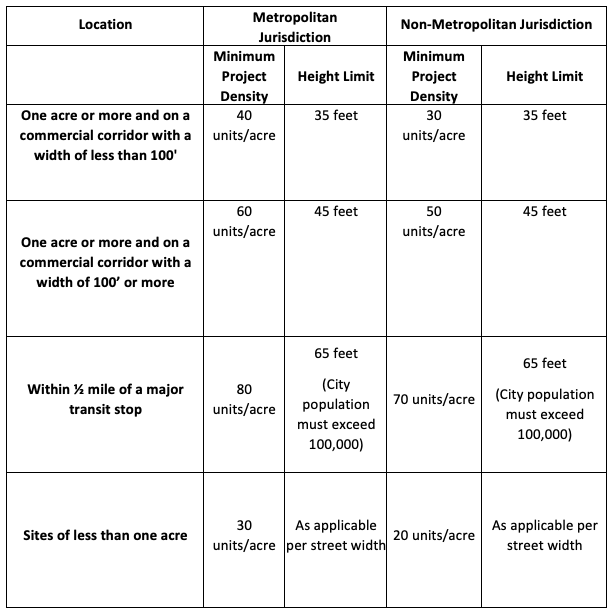

Mixed-Income Projects. For mixed-income projects, the minimum density is the greater of the residential density allowed on the parcel by the local government (if at all) or the density stated in the table below. Similarly, the height limit is the greater of the height allowed by the local government for the parcel or the height in the table below.

100% Affordable Projects. AB 2011 prescribes a different method for determining density for a 100% affordable project. The density must meet or exceed the default density under housing element law as appropriate to accommodate housing for low income households. Generally, these densities are:

- For a jurisdiction in a metropolitan county, at least 30 units per acre;

- For a suburban jurisdiction, at least 20 units per acre;

- For an incorporated city within a nonmetropolitan county and for a nonmetropolitan county that has a micropolitan area, at least 15 units per acre; and

- For an unincorporated area in a nonmetropolitan county not included in clause (iii), at least 10 units per acre.

SB 6

SB 6 uses the same density methodology as the 100% affordable project under AB 2011 described above.

Objective Development Standards

AB 2011

AB 2011 requires the project to meet the objective zoning, subdivision and design standards that are in effect at the time the development application is submitted to the local government. The applicable standards are different for mixed-income and 100% affordable projects.

Mixed-Income Projects.

For mixed-income projects, the objective standards will be those for the closest zone that allows multifamily use at the density permitted by AB 2011, as discussed above. If no zone exists that allows for that density, the applicable standards will be those of the zone that permits the greatest density in the jurisdiction.

100% Affordable Projects.

For 100% affordable projects, the objective standards will be those for the zone that results in the greater density between: (i) the existing zoning designation if it allows multifamily use, or (ii) the zoning designation for the closest parcel that allows residential use at the density permitted by AB 2011, as discussed above.

For both mixed-income and 100% affordable projects, if the applicable objective zoning and general plan standards are mutually inconsistent, the project will meet the objective standards if it is consistent with the general plan standards.

SB 6

Under SB 6, an eligible project is subject to the local zoning, parking, design and other ordinance and procedures applicable to the zone that allows for housing with the minimum density required. The project must also comply with all objective local requirements, other than those that prohibit residential use, or allow residential use at a density lower than established under SB 6.

Commercial Tenant Relocation Payment

AB 2011 and SB 6

Qualifying commercial tenants that would be displaced by a project using SB 6 or a mixed-income project under AB 2011 are entitled to receive a relocation payment from the developer. The two bills include identical commercial tenant provisions.

To be eligible, the tenant must (i) be independently owned and operated with its principal office in the same county as the leased property; (ii) employ 20 or fewer employees; (iii) have annual average gross receipts under $1,000,000 for the three year period that precedes the expiration of its lease; (iv) still be in operation on the site at the time its lease expires; and (v) its lease needs to have expired within the three years following the development application submittal and not be renewed by the property owner. A tenant that had not previously entered into a lease on the project site yet enters into one following submission of the development application is ineligible for relocation payment, even if it otherwise meets the eligibility criteria.

The amount of the relocation payment varies depending on the length of time the tenant has been operating on the project site. The payment begins at 6 months’ rent for those on the site for at least one year but less than 5 years. The payment increases with an additional three-months’ increment of rent for each additional five-year lease term. The payment is capped at the equivalent of 18 months’ rent for those tenants on the site for 20 years or more. The amount of the monthly rent is one-twelfth of the total amount paid by the tenant in the last 12 months. The relocation payment must be made upon expiration of the tenant’s lease.

The tenant must use the relocation assistance to relocate its business or for costs of a new business. If the tenant elects not to use the funds for these purposes, then the developer would only need to pay the equivalent of 3 months’ rent regardless of the amount of time the tenant has been operating on the project site.

Project and Site Requirements

AB 2011

Under AB 2011, mixed-income projects and 100% affordable projects must meet a common set of requirements discussed below. Mixed-income projects must satisfy additional requirements explained in the next section.

Requirements for Mixed-Income and 100% Affordable Projects:

To satisfy these requirements, the project must:

- Multifamily. Be a multifamily housing development project (as defined in the Housing Accountability Act);

- Zoning. Be located in a zone where office, retail, or parking is a principally permitted use;

- Urban Area. Be located on a site that is either within a city where the city boundaries include some portion of either an urbanized area or urban cluster, or is in an unincorporated area, and the legal parcel or parcels are wholly within the boundaries of an urbanized area or urban cluster, in each case as designated by the US Census Bureau;

- Adjoining Uses. Have at least 75% of the perimeter of the site adjoining parcels that are developed with urban uses;

- Proximity to Industrial Uses. Not be located on a site or adjoining any site where more than one-third of the square footage on the site is dedicated to industrial use;

- Specific Types of Land. Not be located on prime farmland, wetlands, habitat for protected species or land identified for conservation and, unless certain requirements are met, within a very high fire hazard severity zone, earthquake fault zone, special flood hazard area, or a regulatory floodway;

- Mobilehomes. Not be on land that is subject to certain laws regulating mobilehomes or recreational vehicles;

- Neighborhood Plans. If the project is on land governed by an adopted neighborhood plan (i.e., a specific plan, area plan, precise plan, urban village plan, or master plan), the site must be in a neighborhood plan area that either (i) as of January 1, 2022, permitted multifamily housing development on the site; or (ii) as of January 1, 2024, permitted multifamily housing on the site and (A) a CEQA notice of preparation for the neighborhood plan was issued before January 1, 2022; (B) the neighborhood plan was adopted between January 1, 2022, and January 1, 2024; and (C) the environmental review for the neighborhood plan was completed before January 1, 2024;

- Vacant Land. If the site is vacant, it may not (i) contain tribal cultural resources that could be affected by the development and the effects of which cannot be mitigated, or (ii) be within a very high fire hazard severity zone;

- Proximity to a Freeway. Not have any of the housing units within 500 feet of a freeway;

- Proximity to an Oil Facility. Not have any of the housing units within 3,200 feet of a facility that extracts or refines oil or gas; and

- Phase I. Complete a phase I environmental assessment and, depending on the results, either complete a preliminary endangerment assessment or mitigate any release of a hazardous substance.

Mixed-Income Projects. AB 2011 establishes an additional set of qualifications for mixed-income housing developments that seek streamlined ministerial review.

To meet these requirements, the project must:

- Commercial Corridor. Abut a commercial corridor (i.e., a highway with a right-of-way of at least 70 feet and not more than 150 feet) and have frontage along the commercial corridor of at least 50 feet;

- Size. Not be greater than 20 acres;

- Prior Residential Use. Not be on a site that (i) would require the demolition of affordable housing, market rate housing occupied within the past 10 years or housing subject to rent control, (ii) was previously used for housing and was demolished within 10 years, (iii) contains one to four dwelling units, or (iv) is vacant and zoned for housing but not multifamily residential use;

- Historic. Not be on a site that would require the demolition of a historic structure listed on the federal, state or local historic register; and

- Setbacks. Meet prescribed setback standards relative to those portions of the property fronting the commercial corridor, side streets, buildings, and adjoining properties.

AB 2011 provides that the local governments may not require parking in mixed-income projects, but may apply standards for bicycle parking, electrical vehicle charging equipment, and parking accessible to persons with disabilities.

SB 6

The qualifications for a project under SB 6 are considerably simpler than under AB 2011. The project must:

- Zoning. Be located in a zone where office, retail, or parking is a principally permitted use;

- Urban Area. Be within a city with urban areas or, if in an unincorporated area, be wholly within the boundaries of an urban area;

- Size. Not be more than 20 acres;

- Proximity to Industrial Uses. Not be located on a site, or adjoining any site where more than one-third of its existing square footage has industrial uses;

- Consistency with Sustainable Community Strategy. Be consistent with an applicable sustainable community strategy or alternative plan approved under SB 375.

Local Government Authority to Exempt a Parcel

AB 2011

Under AB 2011, a local government may exempt a parcel from AB 2011 before a developer submits a development application on the parcel if the local government identifies alternative sites for residential development and makes prescribed written findings. These findings include, for example, that the alternative development would result in (i) no net loss of the total potential residential density in the jurisdiction, (i) no net loss of the potential residential density of housing affordable to lower income households in the jurisdiction, and (iii) affirmative furthering of fair housing.

SB 6

SB 6 also gives local governments the ability to disallow housing on sites that otherwise would be eligible for residential development. To exempt such a parcel from SB 6, the local jurisdiction must make written findings of either of the following: (i) the jurisdiction concurrently reallocated the lost residential density to other lots so that there is no net loss in residential density in the jurisdiction; or (ii) the lost residential density from each exempted parcel can be accommodated on a site or sites allowing residential densities at or above those required by SB 6 and in excess of the acreage required to accommodate the local agency’s share of housing for lower income households. A local jurisdiction can reallocate the residential density from an exempt parcel only if the site or sites chosen by the jurisdiction are suitable for residential development and the site is subject to an ordinance that allows for development by right.

Other Housing Legislation

In using entitlement pathways under AB 2011 and SB 6, developers may also be able to leverage the benefits of other laws intended to streamline residential development, particularly the Housing Accountability Act. AB 2011 projects already meet the affordable housing requirements to use the density bonus, incentives, concessions and waivers of development standards under the state Density Bonus Law. By including the minimum number of affordable units under the Density Bonus law, a project under SB 6 will be eligible for incentives, concessions and waivers, as well.

Further Information

AB 2011 and SB 6 are lengthy and complicated and contain nuances that are beyond the scope of this summary. If you would like to know more about these bills or other laws affecting housing and mixed-use development, please contact any of our experienced land use attorneys.